A carbon tax is imposed by a government to put a direct price on greenhouse gas emissions (per tonne) produced by companies or industries. One of the largest financial tools to combat climate change is a carbon tax. What is a Carbon Tax and Emissions Trading Scheme? Financial incentives and economic mechanisms including carbon pricing have also progressively play larger roles in reducing global emissions. Governments are achieving this by regulating emissions output and encouraging a widespread transition towards electric transportation. To slow global warming, many developed and developing countries have pledged to reach net zero emissions by 2050. Earth.Org takes a look at what countries have a carbon tax and other financial mechanisms as a tool to incentivise parties to reduce harmful emissions and pollution.Īccording to the recent International Panel of Climate Change (IPCC) report, the world is well on its way of reaching a 1.5 degrees Celsius temperature increase by 2040. Then that would mean that more of that burden would be felt by the firms instead of the is powered by over 150 contributing writersĬarbon taxes around the world have been implemented to compensate for the amount of greenhouse gas emissions countries and industries have produced and released to the Earth’s atmosphere. “What we would expect,” Knittel says, “is as you started taxing gasoline or natural gas, more and more alternatives would come around-more EVs, more heat pumps, more ways to switch from gasoline and natural gas and coal. In this way, a carbon price creates economic incentives to reduce carbon emissions and embrace clean energy sources. Firms would be motivated to buy materials from suppliers who can charge less because they emit less CO 2. Companies that can offer lower-carbon products will be able to charge less because they won’t need to pay the tax, drawing customers away from their more polluting competitors. Economists predict that, over time, polluting companies will face pressure from their customers to eliminate the extra cost of their CO 2 emissions, Knittel says. The point of a carbon price, though, is to shift the entire market away from emitting CO 2. When I go to replace my furnace, now an electric heat pump is going to look more attractive because I'll get to keep a bigger chunk of that dividend check each year.” “When I go to buy a new car, because gasoline is more expensive I might buy a more efficient car so I can keep a bigger portion of that check,” Knittel says. Then the dividend goes right into their pockets. So, if they avoid buying CO 2-emitting products like gasoline, they avoid the tax. This strategy also gives those who can avoid emitting CO 2 a financial motive to do so, Knittel says: They’re going to get the dividend from the government no matter what they do. Returning the tax revenue to consumers gives them money to pay for electricity or gasoline that the tax may have made more expensive.

One way to do this is to give the tax money back to the people through what’s called a dividend, an approach already being tested in places like British Columbia.

However, Knittel says, there are ways to structure a carbon tax so that it is equitable and does not place an undue burden on consumers.

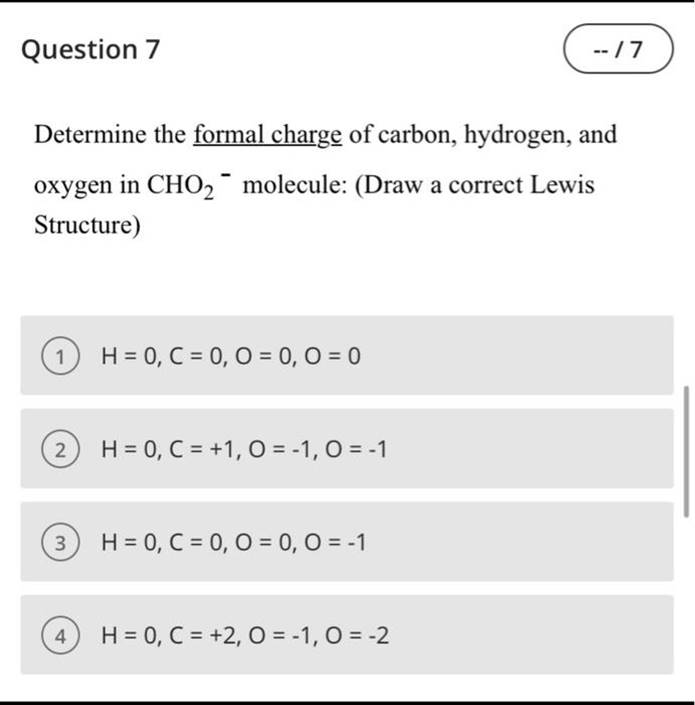

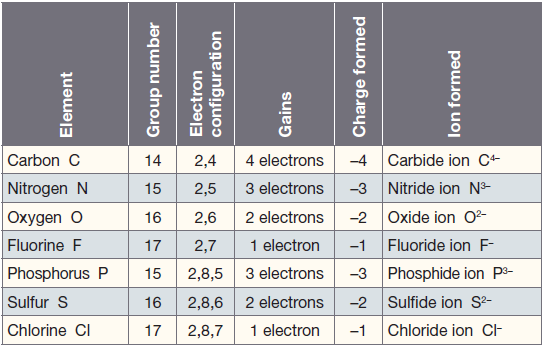

#Charge of carbon drivers

Drivers have had few alternatives to pumping gasoline to power their cars, though electric vehicles are becoming a more mainstream technology. Most people don’t have a choice about where they get the electricity for their homes, for example.

This is especially true in places where demand is inflexible-an economist’s way of describing a situation in which people have few buying alternatives. In the short term, companies probably would pass on the cost of a tax, which means people would pay higher prices, says Knittel. “Part of the goal of carbon taxes is to have prices better reflect the social costs of those products.” Such a plan could charge companies a fee for every ton of CO 2 they produce, which creates an incentive for them to switch to non-CO 2-emitting energy sources like wind and solar.īut what’s to prevent those companies from continuing to burn fossil fuels and simply passing on the cost of the carbon tax to their customers? And if they do, then what would incentivize the polluters to use lower-carbon fuels? Schultz Professor of Applied Economics at MIT. “When I put a gallon of gas in my car, it's leading to 20 pounds of CO 2 that go into the atmosphere that no one pays for,” says Christopher R. They could, but companies will still face pressure to clean up their greenhouse gas emissions-and there are ways to relieve the burden for their customers.Ī carbon tax is an economic tool that would put a price on emitting carbon dioxide (CO 2) into the air.

0 kommentar(er)

0 kommentar(er)